Bitcoin surpasses $64,000 in search of new record price

Bitcoin (BTC) is approaching its historic high of $64,854 and was only $400 below that. While the long-term trend is still clearly up, there are signs of weakness in the short-term.

The daily chart shows an uptrend for Bitcoin. Last Thursday (14), it broke the $57,200 resistance area. This is the final resistance area before a new record price. Since then, the asset’s price has been rising at an accelerated pace.

What did you think of this news? Come talk about her in the BeInCrypto group on Telegram!

So far, the BTC reached a high of $64,486 on Tuesday (19). That’s about $400 below the current record price of $64,854. Technical indicators on the daily chart are also bullish.

The MACD, which is created by the short-term and long-term (MA) moving average, is positive and rising. This means that the short-term trend is moving faster than the long-term trend. This is seen as a positive sign in uptrends.

The RSI, which is an indicator of market strength, is rising and is above 70. This is also a positive signal in an uptrend and supports the continuation of the current bullish movement. Therefore, the daily chart suggests that a breakout will occur and the BTC will renew its historic high.

Future moves

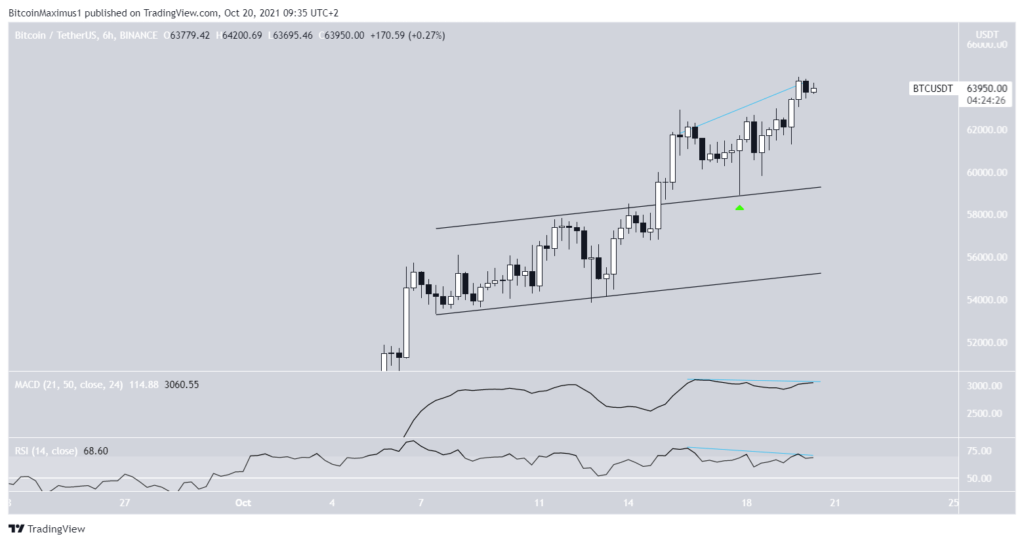

The six-hour chart shows that Bitcoin has broken a bullish parallel channel and has rebounded after hitting that channel’s resistance line next (green icon). This suggests that the resistance line is now likely to act as a price support.

However, unlike the daily chart, there are signs of weakness as both the RSI and MACD generated bearish divergences. This means that the rise in price was not accompanied by a similar rise in buying strength, which could lead the asset to pull back.

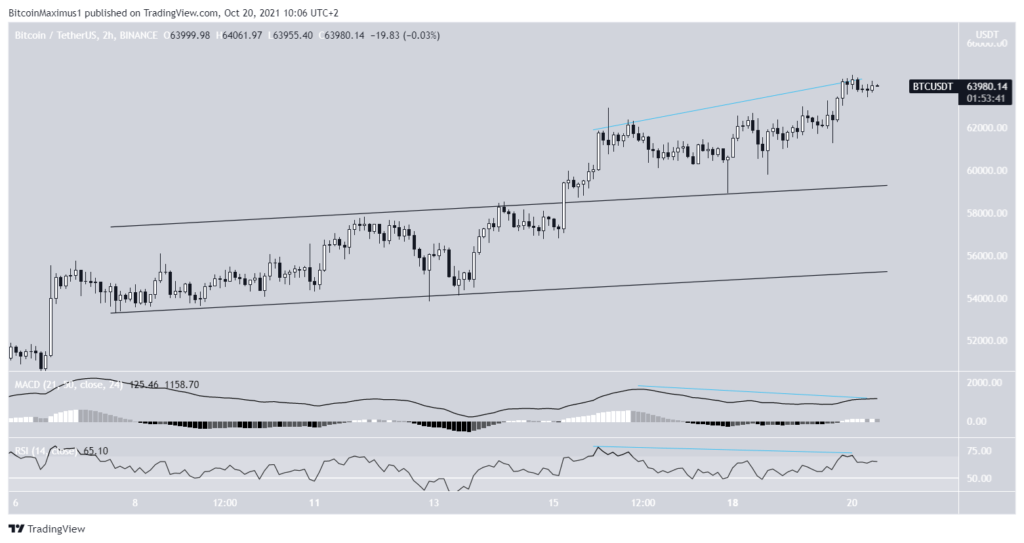

A similar outlook is given by the two-hour chart, which shows even more evident bearish divergences.

Bitcoin wave count

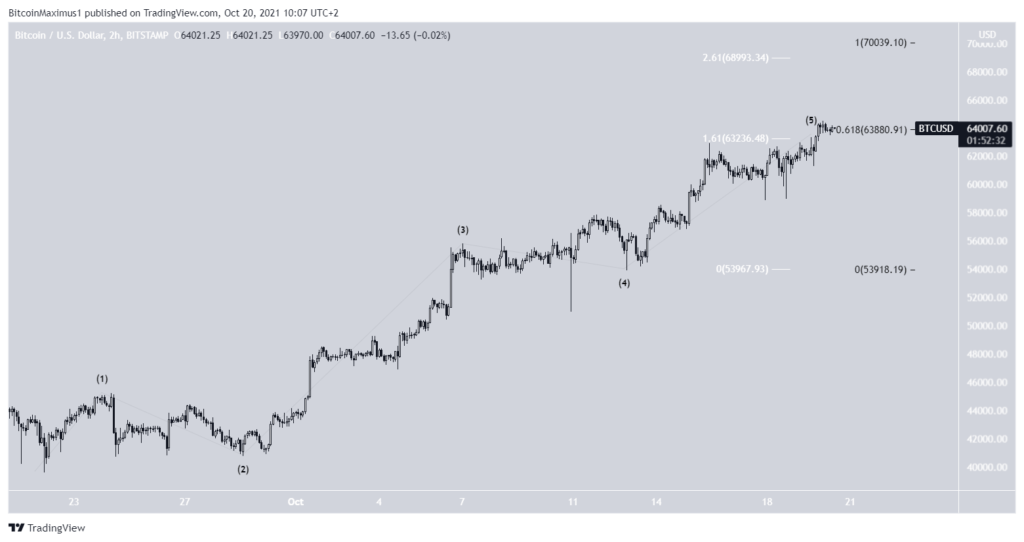

The wave count shows that Bitcoin is on the fifth and last wave of a bullish impulse (black). This means that after the completion of the current movement, a period of price correction is likely to take place.

The BTC is currently within the first likely area that could function as a top. This area is created by the length of 1.61 of wave one (white) and the length of 0.618 of wave 1-3 (black).

If the move extends, the next level that could act as a top is between $69,000 – $70,000. This band is created by the length of 2.61 of wave one (white) and the length of 1:1 of waves 1-3 (black).

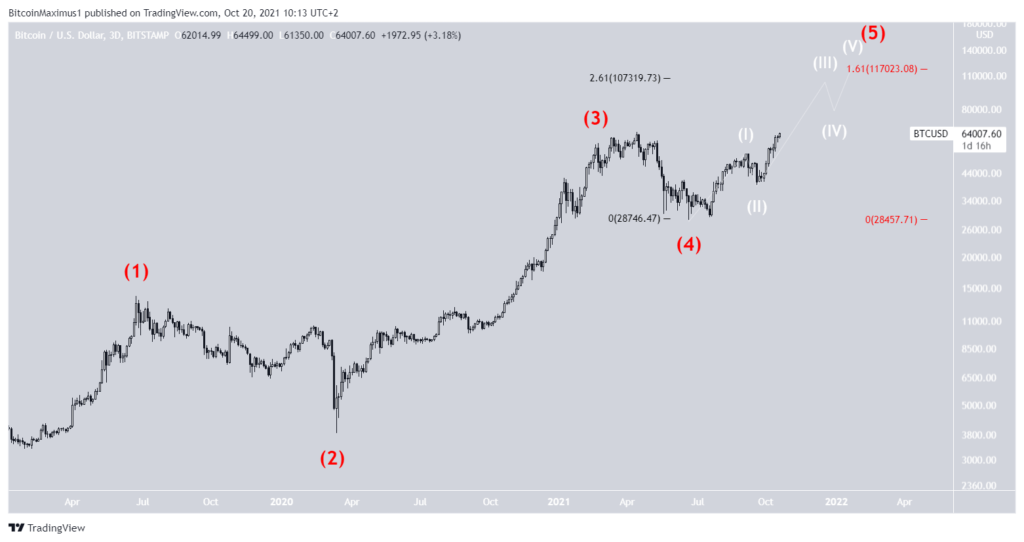

As for the long-term count, the BTC also appears to be on wave five (red) of an upside momentum that started in December 2018. So the uptrend has been around for nearly three years. Subwave count is shown in white.

A possible target for the top of this move is between $107,000 and $117,000. This target is found using an external Fibonacci retrace on wave four (black) and the length 1:1.61 of waves 1-3 (red). These pullbacks are used to find the highest resistance levels when the price is at an all-time high.